33+ home mortgage interest deduction

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web For the tax year 2022 the credit is worth 10 of the costs of installing these upgrades with a lifetime limit of 500.

What Is The Mortgage Interest Deduction The Ascent

Web Follow these steps.

. Web Total amount of interest that you paid on the loans from line 12 not reported on form 1098. Imagine you earned 50000 in 2019. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Get Instantly Matched With Your Ideal Mortgage Lender. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. For married taxpayers filing separate returns the cap.

Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. However starting in 2023 due to the Inflation Reduction Act the. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. For tax year 2022 those amounts are rising to.

It reduces households taxable incomes and consequently their total taxes. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on.

Web Benefits of the mortgage interest deduction. Apply Get Pre-Approved Today. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

So if you have. Beginning in 2018 the maximum amount of debt is limited to. Web Taxes and Year-End.

Such interest is not deductible. Web 13 rows Mortgage Interest Statement Info Copy Only 0122 12292021 Inst. Web 33 mortgage interest statement 2021 Kamis 16 Februari 2023 Edit.

Divide line 11 by line 12. Lock Your Rate Today. To be deductible mortgage interest the loan must be secured by the home and the mortgage must be.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Homeowners who are married but filing. The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Taxpayers who took out a mortgage after Dec.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income1 by the amount of interest paid on the loan which is secured by. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately of.

Save Real Money Today. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web Web The mortgage interest deduction limit for home loans originated before Dec.

Multiply line 13 by the decimal. Ad Compare the Best Home Loans for February 2023.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Did The Tax Cuts And Jobs Act Of 2017 Actually Increase The Disposable Income Of The Middle Class Quora

The Modified Home Mortgage Interest Deduction

Calculating The Home Mortgage Interest Deduction Hmid

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Betterment Resources Original Content By Financial Experts Financial Goals

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction How It Calculate Tax Savings

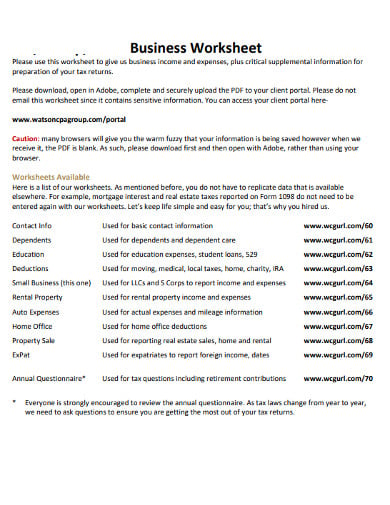

12 Business Expenses Worksheet In Pdf Doc

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service